A Solution to Simplify Transactions in A Secure Manner Compliance with RBI Guideline on CoF Tokenization

India’s digital payments business has grown rapidly in recent years, owing in part to the COVID-19 pandemic, but also to the promotion of innovative technology. E-commerce, consumer behavior, progressive government initiatives, and the worldwide pandemic have all pushed India to the forefront of digital payment innovation. Because of security concerns and travel restrictions, online transactions have risen considerably, with Razorpay forecasting an increase of 80% in 2020 over 2019.

What are the most recent guidelines from the RBI on CoF tokenization?

According to RBI guidelines “No entity in the card transaction/payment chain, other than card issuers and/or card networks, shall store the actual card data,”. Any previously stored such data will be destroyed.” However, the RBI has clarified that, in accordance with applicable financial regulatory norms, organizations can save limited data — the last four digits of the actual card number and the card issuer’s name – for transaction tracking and/or reconciliation purposes.

To make payment more secure, the RBI has asked every merchant and payment gateway to remove any sensitive customer data on their end. Merchants must use encrypted tokens to make transactions under the new law. Individuals making digital payments in India would have to manually enter all of their details from January 1, 2022. The RBI, on the other hand, has given merchants and companies the opportunity to tokenize transactions in order to ensure consumer convenience while transacting online and to eliminate the inconvenience of entering details every time.

What is Tokenization, and how does it work?

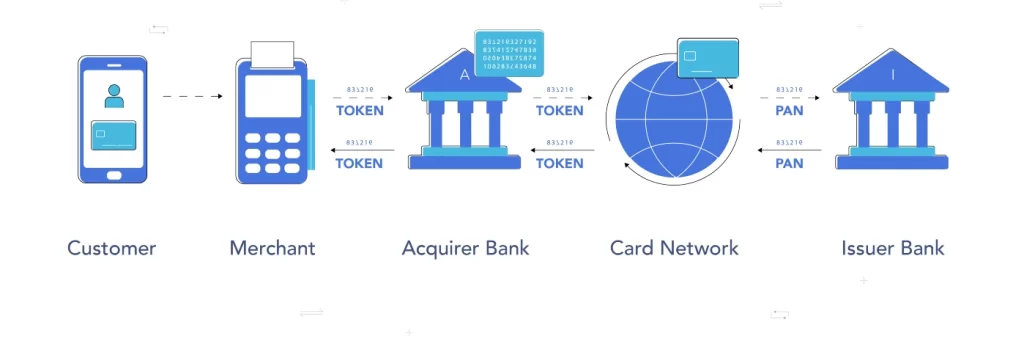

Tokenization is the process of replacing actual card details with a unique code known as a “token” — a combination of card, token requestor, and identified (approved) device.

The card details will be turned into a unique token that is specific to the individual’s card and may only be used by one merchant at a time throughout this procedure. This token masks the true details of the individual’s card, eliminating the possibility of abuse. It can be saved on the server of the online portal.

This new payment method was created primarily to ensure that transactions go smoothly without exposing customers’ personal information. For digital payments, details such as the debit or credit card number, CVV number, and expiration date will no longer be necessary after tokenization.

How does CryptoBind Tokenization aid in boosting security while adhering to RBI guidelines?

Tokenization with CryptoBind improves security without compromising the consumer experience. To protect cardholder data, CryptoBind offers a safe and efficient tokenization solution. It allows users to securely keep their credit card information in mobile wallets, point-of-sale terminals, and e-commerce sites, allowing the card to be charged several times without revealing the cardholder’s personal information.

CryptoBind offers two types of tokenization solutions: vault less and vaulted tokenization.

CryptoBind Secure Vault – Vault based Tokenization:

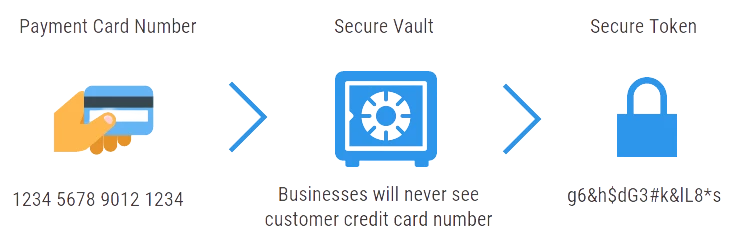

CryptoBind “SecureVault” – The process of replacing sensitive information with tokens and encrypting original data in a data vault is known as vault-based tokenization. The tokens created using this method are irreversible.

CryptoBind Secure Token – Vault less Tokenization:

“SecureToken” from CryptoBind is a secure and advanced way of tokenization that is Vault less. Because it does not use a database and instead uses secure cryptographic devices, it is more efficient and safer than vault tokenization.

How does CryptoBind Tokenization help in achieving privacy and data security?

By replacing personally identifiable information such as credit card account numbers with non-sensitive and random strings of characters, known as a ‘Token,’ Tokenization can avoid regulatory penalties and protect sensitive data while preserving the data’s format and ability to extract the real information. To achieve privacy compliance with CryptoBind, you can use REST APIs to substitute tokens for sensitive data. This helps to break the link between sensitive data and avoid revealing sensitive data in the event of a data breach.

About us:

JISA Softech is a cryptography-focused information technology company based in India. We offer cryptographic solutions to financial institutions, manufacturers, enterprises and government agencies. Our primary product lines have included industry-compliant Hardware Security Modules, Key Management Solutions, Tokenisation, Encryption, Aadhaar Data Vault, and Authentication solutions. All our Cryptographic solutions are sold under the brand name CryptoBind. Our innovative solutions have been adopted by businesses across the country to handle mission-critical data security and data protection needs.

To know more about us visit:

Website: www.jisasoftech.com

Email: sales@jisasoftech.com

Phone: +91-9619222553